Wells Fargo & Company Lowers NuStar Energy (NYSE:NS) Price Target to $17.00

Wells Fargo & Company Lowers NuStar Energy (NYSE:NS) Price Target to $17.00

Sat Mar 26, 2022 8:30 am

Abstract:(NYSE:NS) had its target price reduced by investment analysts at Wells Fargo & Company from $19.00 to $17.00 in a research note issued to investors on Thursday, Benzinga reports. The firm currently has an "overweight" rating on the pipeline company's stock. Wells Fargo & Company's target price suggests a potential upside of 19.72% from the company's current price.

(NYSE:NS) had its target price WikiFX reduced by investment analysts at Wells Fargo & Company from $19.00 to $17.00 in a research note issued to investors on Thursday, Benzinga reports. The firm currently has an “overweight” rating on the pipeline company's stock. Wells Fargo & Company's target price suggests a potential upside of 19.72% from the company's current price.

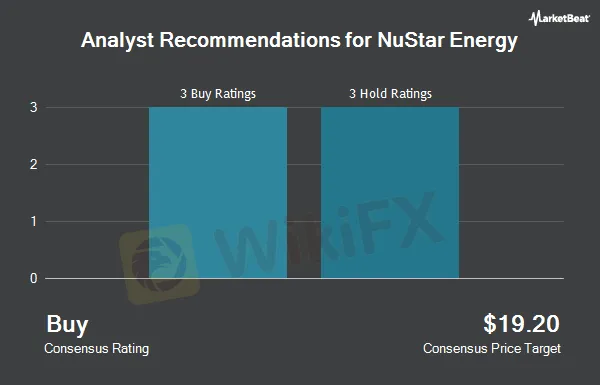

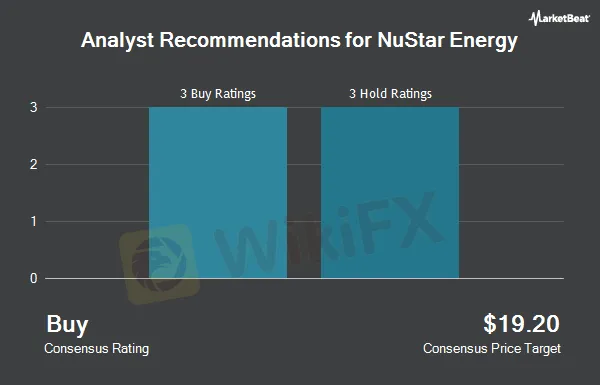

For Other equities research analysts have also issued research reports about the stock. UBS Group upgraded shares of NuStar Energy from a “neutral” rating to a “buy” rating in a report on Friday, November 5th. Zacks Investment Research lowered shares of NuStar Energy from a “hold” rating to a “sell” rating and set a $18.00 target price for the company. in a report on Tuesday, October 19th. Two investment analysts have rated the stock with a sell rating, four have issued a hold rating and three have issued a buy rating to the stock. Based on data from MarketBeat.com, the company currently has a consensus rating of “Hold” and a consensus price target of $18.33. Shares of NYSE:NS opened at $14.33 on Thursday. NuStar Energy has a 52 week low of $13.53 and a 52 week high of $20.73. The stock has a market capitalization of $1.57 billion, a P/E ratio of -10.46 and a beta of 2.51. The firm has a fifty day simple moving average of $15.60 and a two-hundred day simple moving average of $16.53. The company has a quick ratio of 1.72, a current ratio of 1.77 and a debt-to-equity ratio of 14.87. NuStar Energy (NYSE:NS) last released its earnings results on Thursday, November 4th.

The pipeline company reported $0.16 earnings per share (EPS) for the quarter, missing the Thomson Reuters‘ consensus estimate of $0.33 by ($0.17). The firm had revenue of $412.35 million during the quarter, compared to the consensus estimate of $378.58 million. NuStar Energy had a positive return on equity of 53.34% and a negative net margin of 0.24%. NuStar Energy’s revenue was up 13.7% compared to the same quarter last year. During the same quarter last year, the business posted $0.08 EPS. On average, analysts expect that NuStar Energy will post 0.65 earnings per share for the current year. Several large investors have recently bought and sold shares of NS. IFP Advisors Inc raised its holdings in shares of NuStar Energy by 70.6% in the 2nd quarter. IFP Advisors Inc now owns 5,801 shares of the pipeline companys stock valued at $104,000 after purchasing an additional 2,400 shares in the last quarter. Advisor Group Holdings Inc. raised its holdings in shares of NuStar Energy by 12.0% in the 2nd quarter.

Advisor Group Holdings Inc. now owns 57,236 shares of the pipeline company‘s stock valued at $1,033,000 after purchasing an additional 6,135 shares in the last quarter. Lee Financial Co raised its holdings in shares of NuStar Energy by 31.7% in the 2nd quarter. Lee Financial Co now owns 4,291 shares of the pipeline company’s stock valued at $77,000 after purchasing an additional 1,034 shares in the last quarter. Cincinnati Insurance Co. raised its holdings in shares of NuStar Energy by 32.1% in the 2nd quarter. Cincinnati Insurance Co. now owns 111,933 shares of the pipeline companys stock valued at $2,020,000 after purchasing an additional 27,191 shares in the last quarter.

Ultimately, Parkside Financial Bank & Trust raised its holdings in shares of NuStar Energy by 19.9% in the 2nd quarter. Parkside Financial Bank & Trust now owns 4,429 shares of the pipeline company‘s stock valued at $80,000 after purchasing an additional 734 shares in the last quarter. Institutional investors and hedge funds own 57.81% of the company’s stock. NuStar Energy LP engages in the transportation of petroleum products and anhydrous ammonia, and the terminalling, storage, and marketing of petroleum products. It operates through the following segments: Pipeline, Storage, and Fuels Marketing. The Pipeline segment provides transportation of refined petroleum products, crude oil, and anhydrous ammonia.

NuStar Energy LP engages in the transportation of petroleum products and anhydrous ammonia, and the terminalling, storage, and marketing of petroleum products. It operates through the following segments: Pipeline, Storage, and Fuels Marketing. The Pipeline segment provides transportation of refined petroleum products, crude oil, and anhydrous ammonia.

(NYSE:NS) had its target price WikiFX reduced by investment analysts at Wells Fargo & Company from $19.00 to $17.00 in a research note issued to investors on Thursday, Benzinga reports. The firm currently has an “overweight” rating on the pipeline company's stock. Wells Fargo & Company's target price suggests a potential upside of 19.72% from the company's current price.

For Other equities research analysts have also issued research reports about the stock. UBS Group upgraded shares of NuStar Energy from a “neutral” rating to a “buy” rating in a report on Friday, November 5th. Zacks Investment Research lowered shares of NuStar Energy from a “hold” rating to a “sell” rating and set a $18.00 target price for the company. in a report on Tuesday, October 19th. Two investment analysts have rated the stock with a sell rating, four have issued a hold rating and three have issued a buy rating to the stock. Based on data from MarketBeat.com, the company currently has a consensus rating of “Hold” and a consensus price target of $18.33. Shares of NYSE:NS opened at $14.33 on Thursday. NuStar Energy has a 52 week low of $13.53 and a 52 week high of $20.73. The stock has a market capitalization of $1.57 billion, a P/E ratio of -10.46 and a beta of 2.51. The firm has a fifty day simple moving average of $15.60 and a two-hundred day simple moving average of $16.53. The company has a quick ratio of 1.72, a current ratio of 1.77 and a debt-to-equity ratio of 14.87. NuStar Energy (NYSE:NS) last released its earnings results on Thursday, November 4th.

The pipeline company reported $0.16 earnings per share (EPS) for the quarter, missing the Thomson Reuters‘ consensus estimate of $0.33 by ($0.17). The firm had revenue of $412.35 million during the quarter, compared to the consensus estimate of $378.58 million. NuStar Energy had a positive return on equity of 53.34% and a negative net margin of 0.24%. NuStar Energy’s revenue was up 13.7% compared to the same quarter last year. During the same quarter last year, the business posted $0.08 EPS. On average, analysts expect that NuStar Energy will post 0.65 earnings per share for the current year. Several large investors have recently bought and sold shares of NS. IFP Advisors Inc raised its holdings in shares of NuStar Energy by 70.6% in the 2nd quarter. IFP Advisors Inc now owns 5,801 shares of the pipeline companys stock valued at $104,000 after purchasing an additional 2,400 shares in the last quarter. Advisor Group Holdings Inc. raised its holdings in shares of NuStar Energy by 12.0% in the 2nd quarter.

Advisor Group Holdings Inc. now owns 57,236 shares of the pipeline company‘s stock valued at $1,033,000 after purchasing an additional 6,135 shares in the last quarter. Lee Financial Co raised its holdings in shares of NuStar Energy by 31.7% in the 2nd quarter. Lee Financial Co now owns 4,291 shares of the pipeline company’s stock valued at $77,000 after purchasing an additional 1,034 shares in the last quarter. Cincinnati Insurance Co. raised its holdings in shares of NuStar Energy by 32.1% in the 2nd quarter. Cincinnati Insurance Co. now owns 111,933 shares of the pipeline companys stock valued at $2,020,000 after purchasing an additional 27,191 shares in the last quarter.

Ultimately, Parkside Financial Bank & Trust raised its holdings in shares of NuStar Energy by 19.9% in the 2nd quarter. Parkside Financial Bank & Trust now owns 4,429 shares of the pipeline company‘s stock valued at $80,000 after purchasing an additional 734 shares in the last quarter. Institutional investors and hedge funds own 57.81% of the company’s stock. NuStar Energy LP engages in the transportation of petroleum products and anhydrous ammonia, and the terminalling, storage, and marketing of petroleum products. It operates through the following segments: Pipeline, Storage, and Fuels Marketing. The Pipeline segment provides transportation of refined petroleum products, crude oil, and anhydrous ammonia.

NuStar Energy LP engages in the transportation of petroleum products and anhydrous ammonia, and the terminalling, storage, and marketing of petroleum products. It operates through the following segments: Pipeline, Storage, and Fuels Marketing. The Pipeline segment provides transportation of refined petroleum products, crude oil, and anhydrous ammonia.

Permissions in this forum:

You cannot reply to topics in this forum